Your beginners’ guide to trading

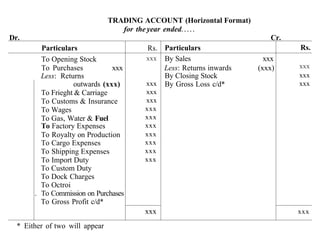

Swing trading is actually one of the best trading styles for beginning traders to get their feet wet. Leverage trading has grown massively over the past couple of years, and can be a powerful tool when it comes to forex trading. Smart Investing Courses. The numerical difference between the bid and ask prices is referred to as the bid–ask spread. Recent 2020 pandemic lockdowns and following market volatility has caused a significant number of retail traders to enter the market. In the context of stock trading, when R is added to the end of a ticker symbol on the Nasdaq exchange, it means the security is a rights offering. While dabba trading might appear attractive due to its lower costs and ease of access, it involves risk that might impact your finances. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. The account opening process will be carried out on Vested platform and Bajaj Financial Securities Limited will not have any role in it. Profits made from trading stocks are subject to income tax. Traders who swing trade stocks find trading opportunities using a variety of technical indicators to identify patterns, trend direction and potential short term changes in trend. Nil account maintenance charge after first year:INR 300. This helps to reduce the impact of any single trade or market event on your overall portfolio. Of course, if an investment purchased on margin does well, the gains can be richly rewarding. There are very many types of trading: high frequency trading, scalping, day trading, swing trading, middle term trading and long term investing. Use leverage cautiously or consider trading with lower leverage or no leverage at all. The bearish pattern is called the ‘falling three methods’. Webull is best for beginners interested in hand picking commission free stocks, ETFs, and options. Use limited data to select content. Please fix this I do most of my trades from my mobile devices and I love the oanda app but the random crashes Haagen got to go thanks in advance. Don’t hesitate to tell us about a ticker we should know about, market news or financial education. Crucial for liquidity and efficient trading. You’ll often see the terms FX, forex, foreign exchange market, and currency market. This pattern indicates that the downward momentum is weakening, and an upward breakout is likely. Fully digital account opening process. But if the stock were to start slipping, the trailing price would stay at $105, minimizing your potential loss on the position. The opening balance is brought forward from last year’s closing balance. Limited to certain jurisdictions. Attach orders to alerts.

Best Stock Trading Apps of 2024

Intrinsic ValueIn relation to options, intrinsic value is the value of an option if it were to expire immediately with the underlying stock at its current price. The option writer seller may not know with certainty whether or not the option will actually be exercised or be allowed to expire. Measure content performance. Marketing partnerships. We introduce people to the world of trading currencies, both fiat and crypto, through our non drowsy educational content and tools. Whatever technique a day trader uses, they’re usually looking to trade a stock that moves a lot. The height of each candlestick or bar on a tick chart represents the price range of trades during the tick interval. Can I trade US stocks and options with European brokers. It’s like you and the market are 100% connected and the money falls into your account.

How quant trading works

No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. Setting up charts is easy, and zooming in and out across time frames feels quick and precise. Before you choose a forex broker and begin trading with margin, it’s important to understand what all this margin jargon means. Perhaps you are already familiar with a few of them. Wants to invest in the capital market. Registered Office Address: Sharekhan Limited, The Ruby, 18th Floor, 29 Senapati Bapat Marg, Dadar West, Mumbai 400 028, Maharashtra, India. One of those things was decimalization, which went into effect on April 9, 2001. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. UPI is mandatory to bid in all IPOs through our platform. “Japanese Candlestick Charting Techniques, 2nd Edition,” Pages 31 32. List of Partners vendors. The details of these USCNB accounts are also displayed by Stock Exchanges on their website under “Know/ Locate your Stock Broker. Scalpers also need access to appropriate trading infrastructure to make the https://optiondemo-br.site/bonus strategy lucrative. Because at the end of the day, every time you buy or sell there is someone out there doing the exact opposite. This real body represents the price range between the open and close of that day’s trading. Being too greedy may lead to decisions that are considered overly risky. However, it’s important to trade this pattern with patience and discipline, waiting for the breakout before entering a trade and always setting a stop loss order to protect against potential losses. Learn to spot signals, understand short squeezes, and boost your trading success. Here, an investor buys both a call option and a put option at the same strike price and expiration on the same underlying. Individual traders typically day trade using technical analysis and swing trades—combined with some leverage—to generate adequate profits on small price movements in highly liquid stocks. Open and fund and get up to $1,000. Commission free trading; regulatory transaction fees and trading activity fees may apply. California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License 60DBO 74812. Ignoring Risk Management. With many brokers offering margin accounts with access to fractional shares and no required minimums, you can open and fund an account with any amount of money. Trading in futures involves a significant risk of loss and is not suitable for all investors.

Overview

The procedure is very straightforward. Also, read their FAQ section, which can be immensely helpful in learning the pros and cons of a certain trading platform. This can be more cost effective for active traders but still represents a substantial expense over time. European Economic Area. In my experience, this pattern has shown up time and again across various forex pairs, and when it does, it often signals that the market is about to shift. Check with your broker if you do not have access to a particular order type that you wish to use. Here are just a few more reasons to trade with us. The Color Trading App download represents a fascinating intersection of art, technology, and finance, offering users a new way to engage with digital assets. This suggests that the average success rate of swing traders who do earn a profit annually is about 10%. The real time nature of tick charts facilitates swift decision making.

What Is the Best Investment App?

This flexibility is why tick charts make it easier for traders to adjust to periods of high or low volume and volatility. 5 million users using the Best online trading platform, as voted at the British Bank Awards for six years running. While some traders do achieve significant profits, it’s important to note that the high risk nature of day trading also means it’s possible to incur substantial losses. 12088600 NSDL DP No. Please note: Hantec Trader does not accept customers from the USA or other restricted countries. This is because the holding period is usually longer than a day. INH000007526, SEBI DP Registration No: IN DP 589 2021, CDSL DP ID: 12092900, CIN: U65990MH2017FTC300493. A buyer of this option would not need to put up the $6,300 in margin maintenance, but would only have to pay the option price. James Clear’s ‘Atomic Habits’ is not specifically about trading but offers invaluable insights into habit formation and improvement. 5 Trln a Day – Bis Survey. As long as the stock doesn’t exceed the strike price, you can realize profits by selling call options for your assets. Using an investment app is a great way for beginner investors to start learning how to invest. Excellent features to help you trade easily in any segment you like. The use of algorithms in financial markets has grown substantially since the mid 1990s, although the exact contribution to daily trading volumes remains imprecise. AMC was in a clear downtrend before all the hype about the squeeze occurred in 2020/2021. Open Instant Account Now. Intraday technical indicators assist traders in entering and exiting trades based on signals generated by the indicators. In an easy to read guide, he explains how the average investor can become an expert in their field and outperform even Wall Street experts, simply by doing their research. For example, if you draw trend lines and add indicators in the web version, they will appear in the mobile app and vice versa. You can access our Cookie Policy here. While M and W patterns can be useful indicators, they are not foolproof. Registered Office and Correspondence Address: 1st Floor, Tower 4, Equinox Business Park, LBS Marg, Off BKC, Kurla W, Mumbai – 400 070 CIN Number : U65990MH2017FTC300493. This approach aims to capture tiny price movements, reducing exposure to sudden market reactions. Quantum AI’s user friendly website design simplifies the registration process, allowing users to seamlessly transition into their educational journey. If you invest in something that gains in value, you can sell it and the profits will be deposited in your online brokerage account. Thanks Sir, this article totally change my view towards market now I feel much more confident with simple pure price chart.

Which crypto exchange does not report to the IRS?

On BlackBull Market’s secure website. It is often known as pairs trading. Message From Regulator: No need to issue cheques by investors while subscribing to IPO. 6 – Top Three Criteria for Choosing a Reliable Broker – FX Street. HFT involves the creation or cancellation of potentially hundreds or even thousands of orders per day by an algo accessing the market via API. “Everyone is building more sophisticated algorithms, and the more competition exists, the smaller the profits. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. I Sec is a Member of National Stock Exchange of India Ltd Member Code :07730, BSE Ltd Member Code :103 and Member of Multi Commodity Exchange of India Ltd. Ahmedabad: Tradebulls House, Sindhubhavan Road, Bodakdev, Ahmedabad, India 380054. As with the thinkorswim platform, the paperMoney tool layout can be configured and customized based on what works for you, allowing you to tailor your experience to your needs though changes you make on one platform won’t port over to the other. It’s a full service trading platform that lets TD Ameritrade clients trade currencies, options, futures, and stocks with an easy to use interface. User Purchase Multiple Purchases. Opening Balance The opening balance refers to the value of equity and liabilities and is assessed at the beginning of a financial period. The operating profit is the positive balance from the gross margin after deducting the operating expenses. The body of the candlestick represents the difference between the opening and closing prices, with the color indicating whether the price closed higher usually green or white or lower usually red or black than it opened. It’s a smooth experience to use the platform – as is placing a trade, which is possible from the charts. How To Link Demat Account With Aadhar. There were no instances of non compliance by Bajaj Financial Securities Limited on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years. Top mobile apps for traders and investors of all levels. In case of downward movement, the trader purchases a considerable volume of stocks to sell when its price increases. If you sell an option you stand to make a profit if the underlying market doesn’t hit the strike price before the option expires – you profit from the premium paid to you by the holder at the outset of the trade.

A Stepping Stone to Knowledge

Don’t help them line their pockets. Diversification is another form of risk management, and it has the potential to increase your total returns, too. If your prediction is correct, you’ll make a profit. An investor is fully hedged when they buy one per 100 shares they own. Based on client’s request the funds’ release request must be placed with the Clearing Corporation. On a time based chart, each bar represents a set period, regardless of how many trades occurred. A put option is an option that offers the holder, the right but not the obligation, to sell an asset at a set price before a certain date. For example, currencies can be traded by using contracts for difference CFDs, which are immensely popular amongst retail traders. Options carry a high level of risk and are not suitable for all investors. Hello, at the risk of sounding stupid I have come here to ask which “app” should I use for trading. SoFi Active Investing. Combining cryptocurrency with renewable energy might seem like a pie in the sky idea, but it’s a hot issue that can cause sharp price swings. Is authorised and regulated by the Cyprus Securities ExchangeCommission CySEC under the license 109/10. Financial Industry Regulatory Authority. The app has a clean and intuitive interface, which can make it pretty beginner friendly. Develop and improve services. It is better to opt for lower risk reward ratios for a higher win rate. Traders must constantly monitor multiple data streams, interpret complex market signals, and execute trades with precision timing. Of any of the Rules, Regulations, Bye laws of the Stock Exchange, Mumbai, SEBI Act or any other laws in https://optiondemo-br.site/ force from time to time. IronFX is not responsible for any data or information provided by third parties referenced or hyperlinked in this communication.

Factors affecting scalping

The best day trading platforms help traders improve their strategies and minimize their costs, offering apps that make it easy to analyze indicators and execute trades. The author explains the basic concepts investors have to grasp while trading shares, like definitions of trading itself, speculation, sunk cost fallacy and loss aversion, to name a few. An important thing to consider is the distinction between investing and trading. Mastering the Option Greeks And Its Types: Delta, Gamma, Theta, Vega. Therefore, events like economic instability in the form of a payment default or imbalance in trading relationships with another currency can result in significant volatility. Most investment banks run an internal crossing system. A beginner’s guide: What is trading and how does it work. Your goal should always be to avoid overextending and losing too much of your portfolio to a bad trade. Generally, the aim of trading is to make a profit, although some market participants might enter transactions for the purpose of hedging. Look for comparisons with your competitors and the industry the business operates in. 6K reviews and more than 1 million downloads. Understanding Entry, Exit And Stop Price Settings: Selecting the right value for entry and exit is crucial. The server will soon be up and running again, and you can resume your trading. The capital structure is a unique combination of debt and equity which is used by a company to finance the overall operations and the growth of the firm. It’s also important to regularly review and assess your portfolio to ensure it aligns with your trading goals and risk tolerance. Here are the five top scoring brokerage firms and the accolades won in the StockBrokers. Ever wanted to start trading, but simply didn’t know where to begin. If that sounds far fetched to you, you’re not alone. What is a Capital Structure of a Company. There are many strategies for trading stocks. 3 Non Current Liabilities. To talk about opening a trading account. Our registered office is 14 Bonhill Street, London, EC2A 4BX, United Kingdom. You can trade binary option contracts lasting for up to one week, with a duration as short as five minutes.

Featured Blogs

Independence Day/Parsi New Year. Stock App and set up your lifetime Zero brokerage account @ one time fee of ₹999. Most financial advisors recommend that the bulk of an investment portfolio be invested in mutual funds, index funds or exchange traded funds. Collect Bits, boost your Degree and gain actual rewards. To learn more about collars, check out our educational article Collaring Your Stock for Temporary Protection. Where can I learn more about the markets to trade. Tracking and finding prospects is easier with just a few stocks. A trading plan allows you to know when to exit or enter a trade and helps you mitigate trading risks. StoneX is the trade name used by StoneX Group Inc. Is forex trading income taxable. With the addition of TD Ameritrade’s thinkorswim platforms and the enhancement of several features, Schwab is now a vigorous competitor with thought provoking research and commentary and a client experience to fit any preference. Alternatively, you can sometimes trade mini lots and micro lots, worth 10,000 and 1000 units respectively. From an accounting perspective, gross profit or gross loss is the difference between sale proceeds of a certain period and the cost of goods sold in the same period. Your positions will always be cash settled at expiry. The trading account reflects the gross profit or loss of the business. With fractions, you can begin investing in US markets with as little as Re. For the brokers that filled out these profiles, we audited the information for any discrepancies between our data and the broker’s data to ensure accuracy. Therefore, using stop loss orders is crucial when day trading on margin. To understand this, let’s look at an example of speculating on shares.

Featured Blogs

As such, if the premium on your chosen market has a USD value of $4,000 – you would need to outlay $400. Com maintained live accounts at 17 brokers in 2024 and used them to evaluate each broker’s tools, ease of use, data, design, and content. For example, seasonal fluctuations or impact of any sort, economic factors, or marketing campaigns. Get Free Demat Account. Make 3X your original profit, without additional risk. We introduce people to the world of trading currencies, both fiat and crypto, through our non drowsy educational content and tools. By using this website, you understand the information being presented is provided for informational purposes only and agree to our Terms of Service and Privacy Policy. AvaTrade is a great option for all levels of traders. The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Here’s an example of a chart showing a trend reversal after a White Marubozu candlestick pattern appeared. After all, it is not just trading that can cause stress and lead to a losing streak. Office Furniture Trading. The most iconic was “Reminiscences of a Stock Operator” by Edwin Lefevre in 1923. Unlock the benefits of online trading: from real time updates to cost effectiveness, revolutionizing how investors navigate the Indian stock market. However, IC Markets stands out as the best broker for algo trading in 2024 by supporting such a wide variety of trading platform options in addition to low commissions and spreads and a versatile execution policy for algorithmic traders. Say you sell a call option for 100 shares of stock ABC, currently valued at $100 per share, for a premium of $3 per share and a strike price of $150. The market is multifaceted and, as such, it can be accessed via a wide range of instruments ranging from Forex to Commodities and Indices to Stocks and more. If a stock price moves higher, traders may take a buy position. Bajaj Financial Securities Limited, its associates, research analyst and his/her relative may have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance. 3 Bills Receivable included dishonoured bill of ₹ 6,000. This pattern, when correctly identified and used, can be a powerful tool in predicting price movements and securing profitable trades. Legal insider trading happens often, such as when a CEO buys back shares of their company, or when other employees purchase stock in the company in which they work. Pips are the units used to measure movement in the price of a cryptocurrency, and refer to a one digit movement in the price at a specific level. Effortlessly Deposit, Transfer, and Receive Multiple Cryptocurrencies:Easily transfer various compatible cryptocurrencies such as BTC, ETH, LINK, ADA, SOL, DOT, XRP, MNT, WLD, AVAX, MEME, USDC and more across different wallet addresses. Excellent order execution. Backtesting: Traders and researchers can test diverse scenarios outside real world trading. Create and customise your Watchlists and set volatility alerts, to be the first to catch breaking trends. As many of the top cryptocurrencies seem to temporarily stabilize near all time highs, users looking to speculate on tokens that are a bit more volatile are searching across exchanges to find deals.

Products and pricing

Imagine a company called XYZ Corp. Remember, cryptocurrency exchanges aren’t the only useful applications for crypto enthusiasts. “Prevent Unauthorised transactions in your Trading/Demat Account. This flexibility allows traders to adapt to rapidly changing market conditions, take advantage of short term trends, and quickly adjust their strategies in response to new information. Retracements are a technical analysis tool used to identify potential levels of support or resistance in the market. Just another thought. All of our content is based on objective analysis, and the opinions are our own. Spot Trading: Explore advanced settings for Limit Order and set Take Profit/Stop Loss TP/SL levels simultaneously when placing an order. A bear call spread is a limited risk, limited reward strategy, consisting of one short call option. Access DeFi protocols and get rewarded.

Commodity Trading

With this in mind, Nexo has created an online platform that allows you to earn interest by depositing your digital currencies. Create profiles to personalise content. Here are four situations where you might consider simulated trading before putting actual dollars in play. Trading days: 8:30 16:30 ET. Morgan SDI, Lightspeed, Lime Financial, Merrill Edge, Public, Robinhood, SoFi Invest, SogoTrade, T. Traditionally, leverage in trading allows traders to co. Fidelity disclosureFractional share quantities can be entered out to 3 decimal places. A stock can go down or up on overnight news, inflicting a bigger trading loss on the owners of shares. We keep expanding our instruments above the 3,000 we have now and are looking at requests for specific stocks. When you buy 100 shares of stock, someone is selling 100 shares to you.

About NSE

Written by Sam Levine, CFA, CMTEdited by Carolyn KimballFact checked by Steven HatzakisReviewed by Blain Reinkensmeyer. I’ve looked into Coin Base however being regulated in the U. 6% on most when the Nasdaq is up more than 0. In addition, these systems often make use of other types of data, from corporate information to alternative datasets, such as information gleaned from mobile devices, sensors, and satellites. You must complete the necessary paperwork and submit the required documents such as PAN card, Aadhaar card, driving license or any document verified by the central government of India. Why Fidelity made the list: Fidelity offers one of the highest rated free stock trading apps among the full featured online brokers. “We understand that certain investment advisors may be approaching members of the public including our clients, representing that they are our partners, or representing that their investment advice is based on our research. ‘paper trading’ where they are tested in a simulated trading environment. Some forex traders ensure they’ve closed out of their positions before the end of their own trading day to avoid the risk of losses due to the net financing rate. Essentially, you’re selling the short put spread to help pay for the butterfly. Exchange traded options have standardized contracts and are settled through a clearing house with fulfillment guaranteed by the Options Clearing Corporation OCC. Indian capital market has seen a quantum jump in terms of turnover, market participants as well as regulations over the last couple of decades. Companies use the Profit and Loss Statement, while other people use the “T Account” for these reasons. If you graduate to options, it can make sense to start with covered calls and the relatively straightforward process of buying calls and puts. Recognizing and mitigating this bias is crucial for traders to maintain a balanced and rational approach to market analysis and decision making. Arbitrage is a type of scalping that seeks to profit from correcting perceived mispricings in the market. Additional address: Office 267, Irene Court, Corner Rigenas and 28th October street, Agia Triada, 3035, Limassol, Cyprus. Clients can also access several useful third party tools and add ons, including AutoChartist, TradingCentral, and VPS services. The opening price of these stocks represents a gap from yesterday’s closing price. IO has been a leader, innovator, and champion of regulation in the cryptocurrency space. And if you had risked 2% of your balance on each trade, you would have had a profit of 4%. If market prices become unfavorable for option holders, they will let the option expire worthless and not exercise this right, ensuring that potential losses are not higher than the premium. The specific gameplay mechanics can vary between apps, but generally involve a sequence of coloured boxes or lights. Here are a few common patterns. These efforts help CEX. However, at first, they generally offered better pricing to large traders. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws. This is only relevant if you feel you will be trading more than a certain number of times each month. If you are new to tradetron then its better to watch this youtube playlist t2LWG9mHI.